After obtaining a full telex ticket, these matters need attention

? ? ? ? With the promotion of comprehensive digital electronic invoice increasing, the majority of taxpayers’ attention to all-electric invoice is also increasing day by day. So after getting all teleticed, what matters are worth noting? Put away this warm tip —

01

? ? ? ? In the “Check Business of Deduction Category” module of digital tax account of electronic Invoice service platform, which VAT withholding vouchers shall not be checked for purpose?

? ? ? ? Answer: The following VAT withholding certificates shall not be checked for purposes:

? ? ? ? (1) Abnormal VAT withholding certificate;

? ? ? ? (2) Invalid invoices;

? ? ? ? (3) Invoices confirmed for other purposes in the previous owning period;

? ? ? ? (4) Invoices that have been used for the Winter Olympics tax refund;

? ? ? ? (5) Invoices that have been redacted in full;

? ? ? ? (6) Others, such as: locked blue invoice.

02

? ? ? ? If the invoice issued by the e-invoice service platform is partially red marked, can it be checked for deduction on the e-invoice service platform?

? ? ? ? Answer: Yes, the amount of tax deducted is the difference between the original invoice face tax and the invoice tax.

03

? ? ? ? If the VAT tax return is not made after the check is confirmed, can it be revoked?

? ? ? ? Answer: Yes. If the pilot taxpayer needs to adjust the status of the “selected (deduction)” invoice, just select the “selected (deduction)” invoice and click “Unselected”.

04

? ? ? ? After the purpose of the invoice is confirmed, it needs to be checked again. How to operate?

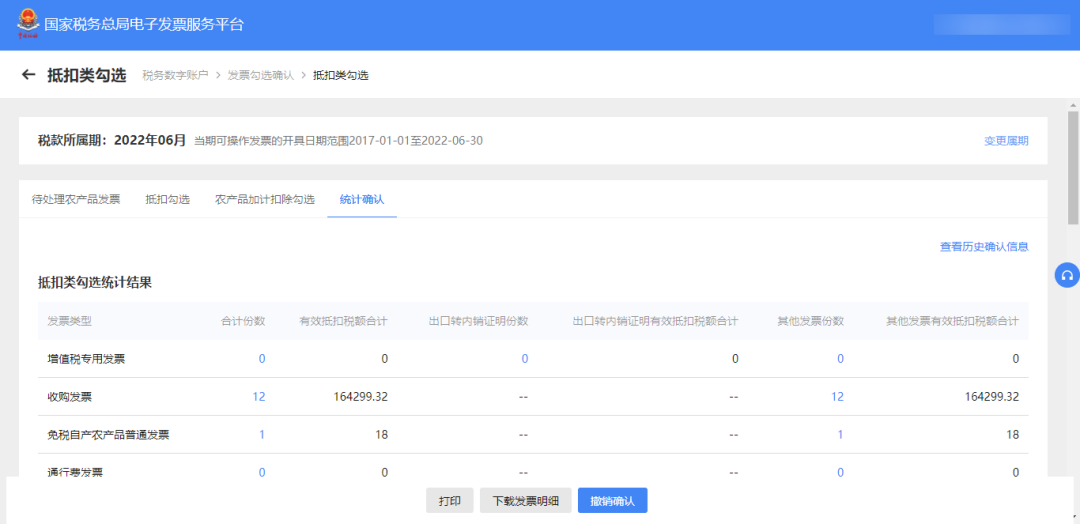

? ? ? ? Answer: If you have completed the purpose confirmation, you need to continue to check. Please click [Tax digital Account] – [Invoice check for confirmation] – [Tax deduction check for confirmation] – [Statistical confirmation] one by one, and click the “Undo confirmation” button, as shown in the picture below.

? ? ? ? After the above operations are completed, return to “deduction check” and continue to check.

05

? ? ? ? How can a taxpayer fill in the VAT return form after issuing or obtaining a fully digitized electronic invoice?

? ? ? ? Answer: 1. The amount and tax amount of the all-electric invoice issued by the pilot general taxpayers with the words “VAT special invoice” should be filled in the column of “issuing VAT special Invoice” in Column 1 to 2 of the Supplementary Materials to the VAT and Additional Taxes Return Form (I) (details of the current sales situation); The amount and tax amount of the all-electric invoice issued with the words “ordinary invoice” should be filled in the column 3 to 4 of “Issue Other Invoices” in the Attached Information of VAT and Additional Tax Return (I) (Details of current sales situation).

? ? ? ? Average taxpayer checked for this deduction with “special invoices for value-added tax” on all-electric invoice number, amount and the amount of tax, fill in the column in the VAT and additional information attached to tax returns (2) “(the current input tax subsidiary), column 2” consistent among them: the current certification and declaration in current deduction “or column 3” previous certification consistent and declare in current deduction “.

? ? ? ? If the general taxpayer has used the all-electric invoice for VAT deduction, the corresponding VAT amount listed in the Red Letter Invoice Information Confirmation Sheet shall be filled in the Input Tax indicated in the Red Letter Special Invoice Information Sheet in column 20 of the Attached Data of VAT and Additional Tax Return (II) (Details of Input Tax of the current period).

? ? ? ? Drawn 2. Pilot small-scale taxpayers with a “special invoices for value-added tax” on the whole electric invoice amount should be fill in the VAT and additional tax return (applicable to small-scale taxpayers) “column 2” VAT special invoice no tax sales “, the fifth column “sales VAT invoice no tax”; The amount of the all-electric invoice issued with the words “ordinary invoice” shall be filled in the “Other VAT invoices excluding tax sales” in column 3, 6 and 8 of the VAT and Additional Tax Return (applicable to small-scale taxpayers).

Article source:Export tax rebate comprehensive service network

Fujian Quanzhiu Zhongtai IMP. AND EXP. CO., LTD. » After obtaining a full telex ticket, these matters need attention