Customs and foreign trade knowledge: the main difference between imported processing and processing

In the process of export tax rebate, we always have a vague concept of processing with imported materials and processing with supplied materials. It is not clear what is the difference between the two. Don’t worry, let’s first understand the concepts of the next two businesses:

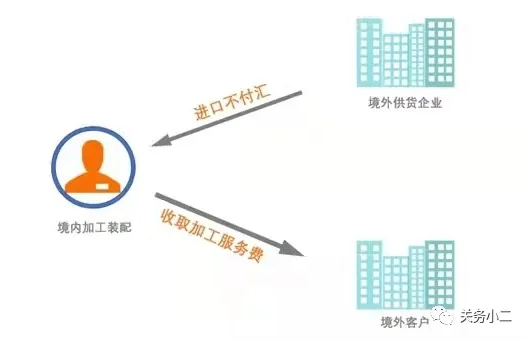

Processing with supplied materials: refers to the business activities in which imported materials are provided by foreign companies, and the operating companies do not need to pay foreign exchange for importing, but process or assemble in accordance with the requirements of foreign companies, only charge processing fees, and the finished products are sold by foreign companies.

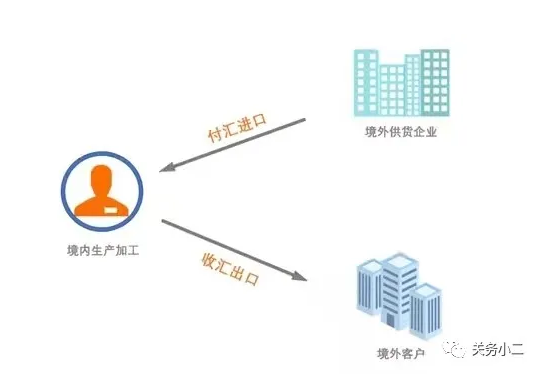

Imported processing: refers to the processing trade in which imported materials are imported by the operating company in foreign exchange, and the finished products are exported by the operating company.

Simply put, processing with imported materials is a trade method in which raw materials are imported from abroad for production and processing in the country, and then the processed products are re-exported. The raw materials imported by domestic enterprises here must be paid in foreign exchange, and the same products must be paid in full when they are exported. The processing of incoming materials also has two ends, but it does not have to pay foreign exchange when importing raw materials, and when exporting products, it only collects processing fee income, not full payment.

Same point

Regardless of whether it is processed with imported materials or processed with supplied materials, the customs are bonded when the raw materials are imported, that is, no value-added tax is temporarily levied. At the same time, the processed products can enjoy tax exemption in the export link, but if the imported materials or products are approved to be converted into For domestic sales, customs duties, value-added tax and consumption tax shall be paid regardless of whether it is processed with imported materials or processed with supplied materials.

According to the current tax law, the “tax exemption and refund” policy is implemented for goods exported by production-oriented export enterprises in the form of processing trade with imported materials, and the policy of “tax exemption” is implemented for goods exported through processing trade.

difference

Let’s take a look at their differences again. We have summarized the following five parts:

Summarize

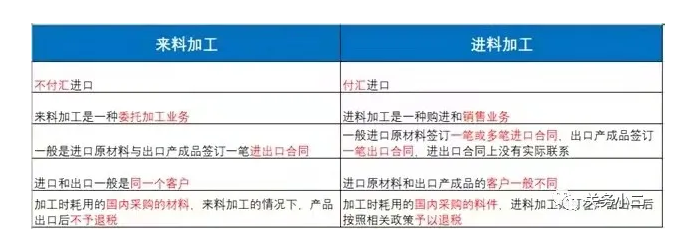

1. Conceptual difference

Incoming processing is provided by foreign companies free of charge, no foreign exchange is required to purchase, only processing fees are charged; while inward processing requires domestic enterprises to pay foreign exchange to purchase to form imports.

2. The ownership of the two is different

The ownership of processing with imported materials belongs to the overseas entrusted enterprise, and the ownership of processing with imported materials belongs to the purchasing enterprise.

Three, the business substance is different

Incoming processing is a kind of commissioned processing business. The processing enterprise is not responsible for the profit and loss, and the entrusted enterprise shall bear the risks, while the incoming processing is a business of purchasing and self-sale. It is responsible for its own profits and losses and bears the risks that may arise.

Four, different customers

It can be understood from the concept that the import and export of processing with imported materials are generally the same customer, while the customers for processing imported raw materials and exporting finished products are generally different.

Five, the contract signing method is different

Generally, only one contract is signed for processing with supplied materials, that is, the entrusted processing contract. The processing with supplied materials will sign two unrelated contracts, one for the import contract and the other for the export contract.

Six, there are differences in taxation

Processing with supplied materials is a duty-free business. Imports are exempt from VAT, while exports are exempt from VAT, and processing fees collected are also exempt from VAT. Since it is tax-free income, the input tax paid by the corresponding domestic goods is not deductible, and does not involve export tax rebates. Processing with imported materials is an export tax rebate business.

Source: Guanwu Xiaoer Reprinted from Easy Learning Export Tax Rebate.

Fujian Quanzhiu Zhongtai IMP. AND EXP. CO., LTD. » Customs and foreign trade knowledge: the main difference between imported processing and processing